Fix. Build. Qualify.

Tired of getting denied? We clean up what’s hurting you and build the right accounts so you can get mortgage-ready. We repair what's hurting your score and build the right accounts lenders love - backed by real results and FCRA compliance

No long-term contracts

Results Reviewed Every ~35 Days

Realtor & loan officer trusted

Led by an Underwriter Who’s Approved 10,000+ Home Loans

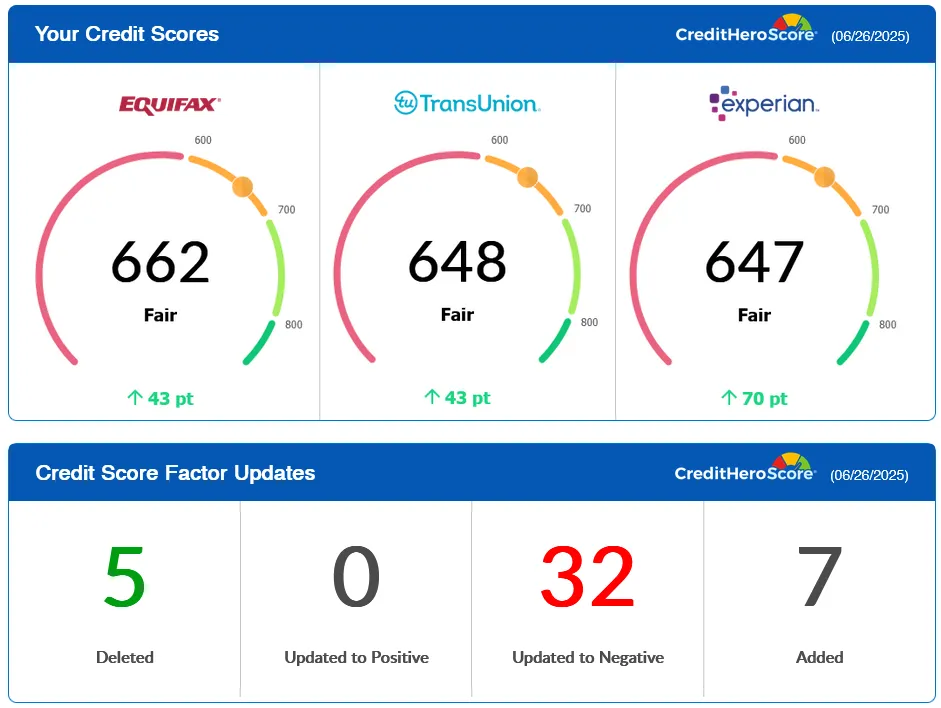

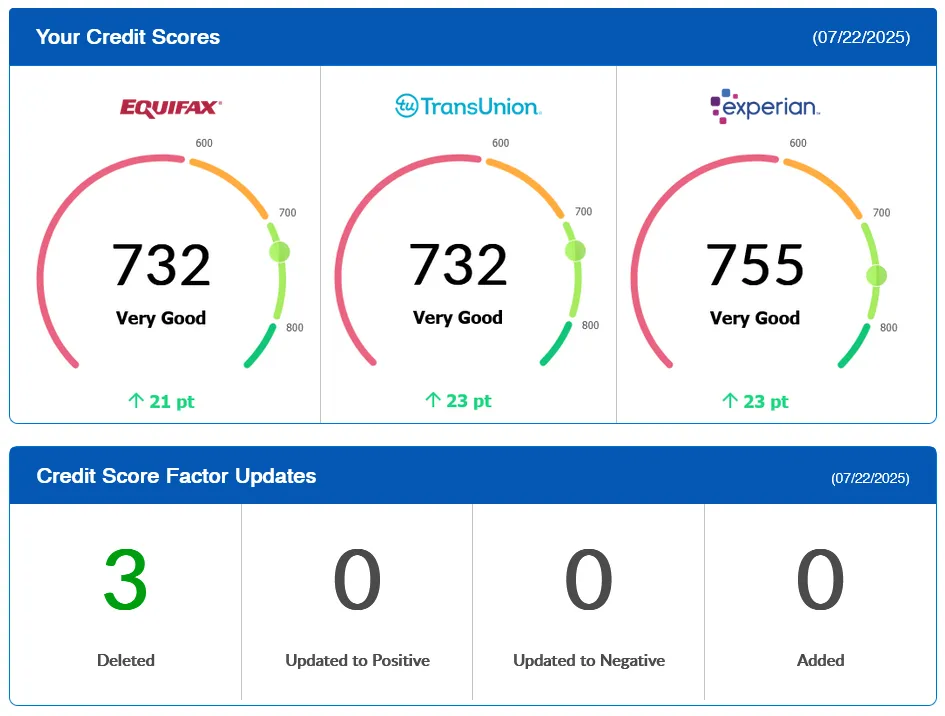

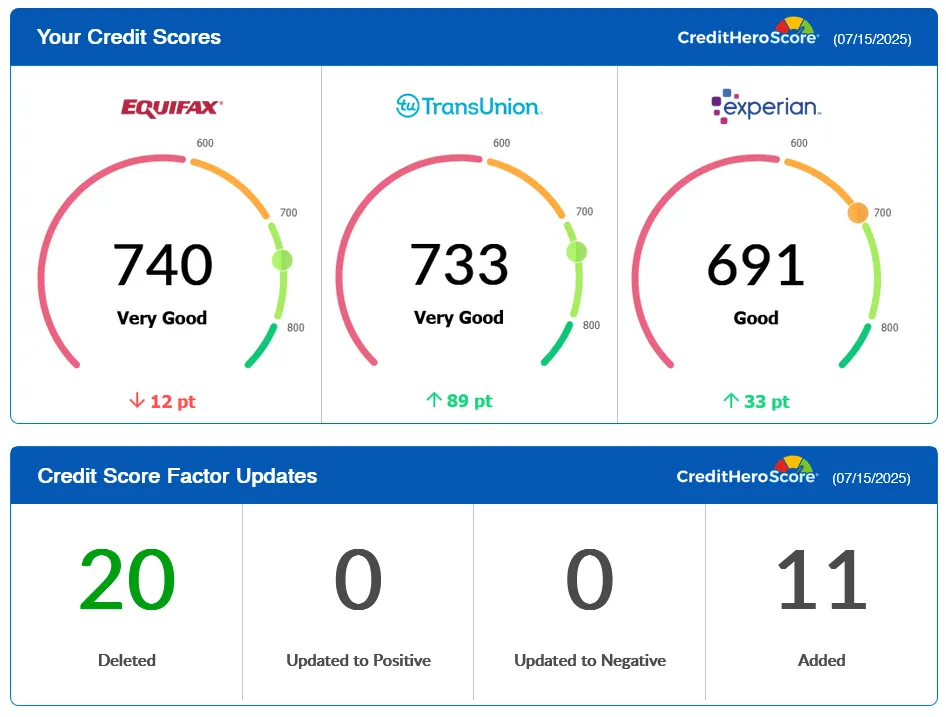

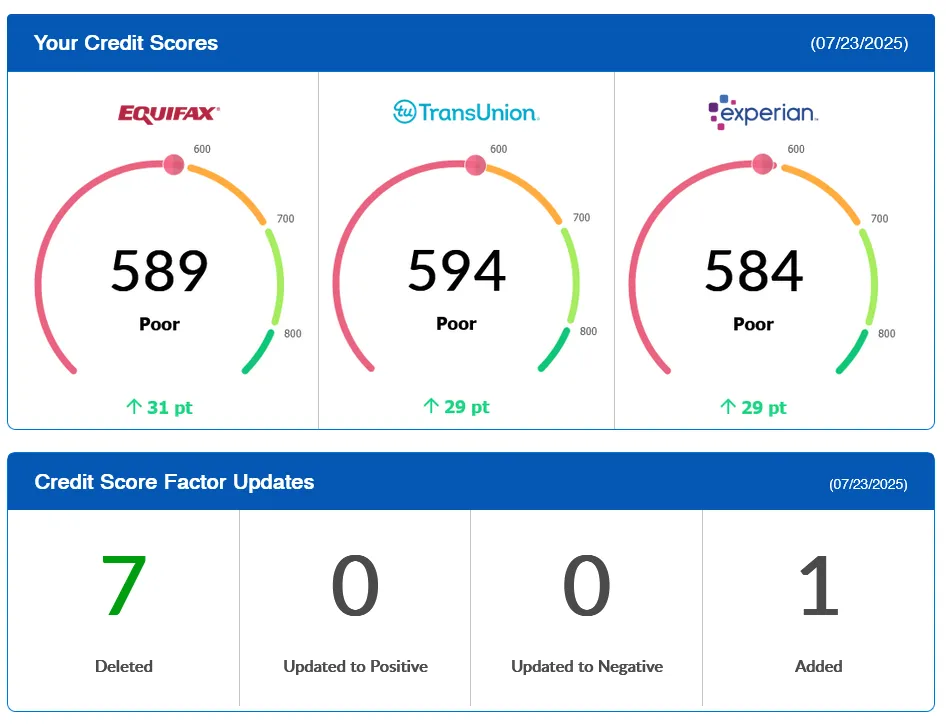

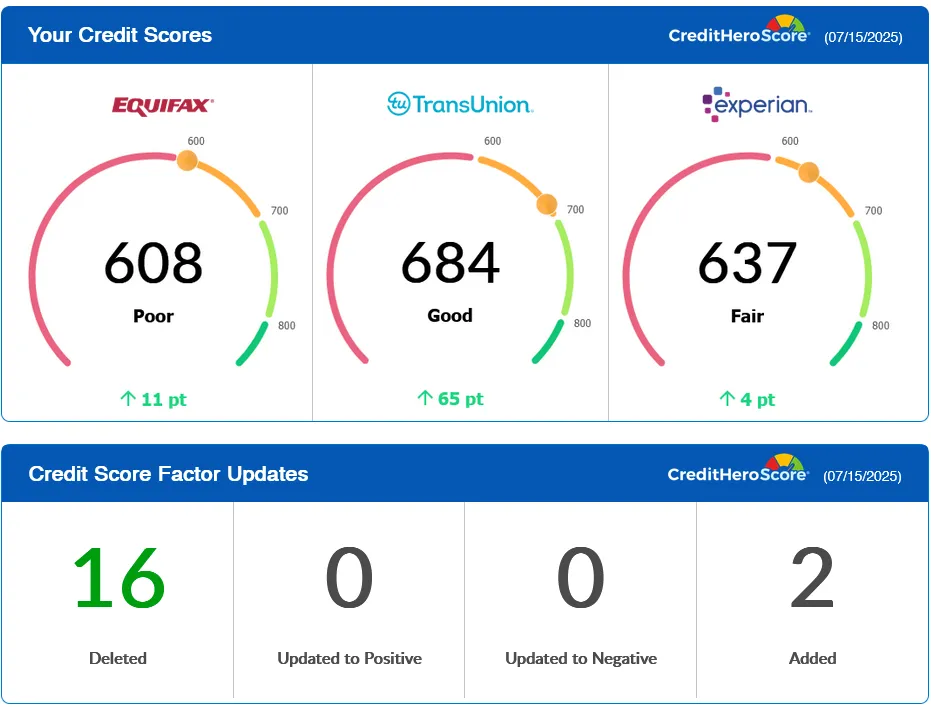

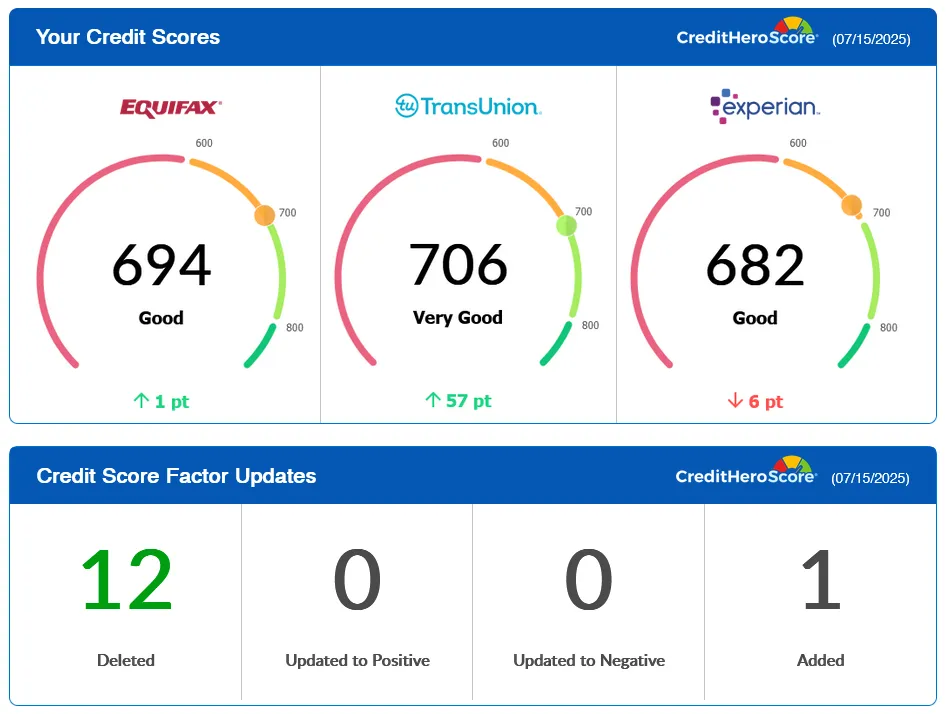

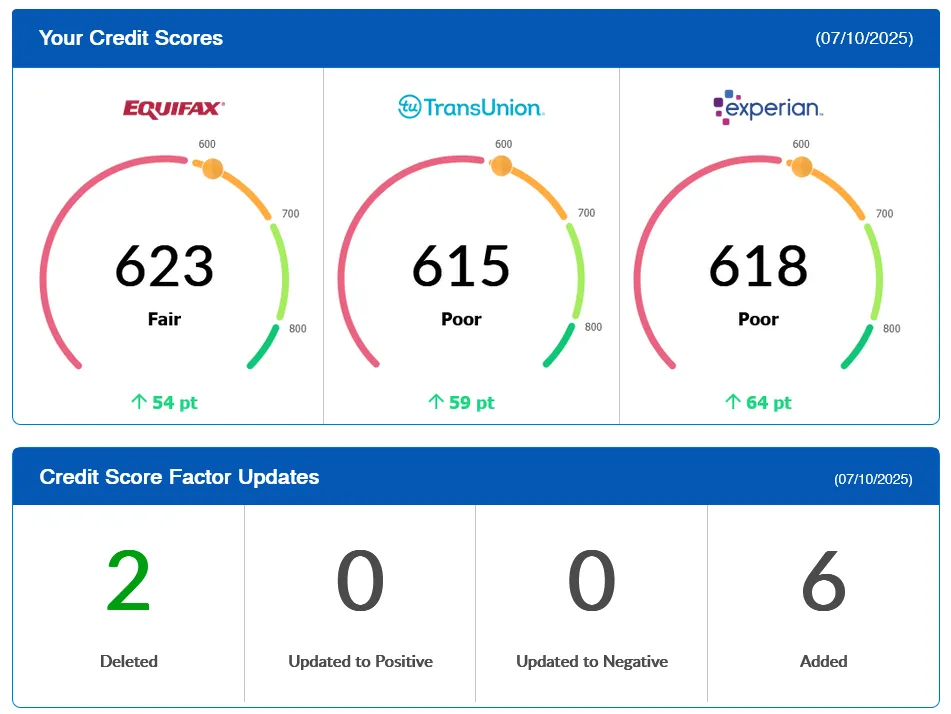

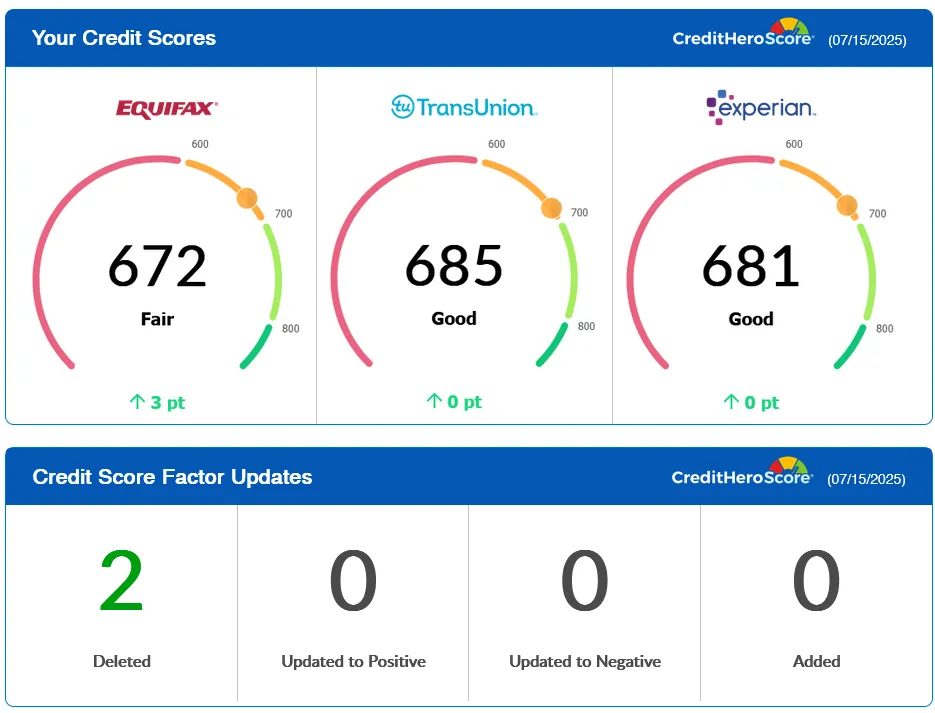

Most active clients see measurable progress within 30–90 days. Results vary by individual credit history.

Jakita C.

“Jay Daniel's was referred to me by a trusted friend. Our consultation was thorough and very informative. I didn't feel rushed. All of my questions were answered and the process of what ScoreCrest can accomplish with repairing my credit and getting me on the road to mortgage approval was efficient. Jay was very personable and sincere.”

Samara D.

“The ScoreCrest Solutions family took amazing care of me! Jay explained everything in a way that was super easy to understand and was very precise throughout the process. My credit results were a 10/10. Thank you!”

Adel C.

“Worked with jay, hes a great and honest man. Him and his team worked really hard to achieve the goals he put out for us.”

Real Clients. Real Results. Hear Their Stories.

Why Join ScoreCrest?

Experience the difference with our advanced credit improvement platform

Mortgage-Ready Method

We focus on what lenders look at (middle score, utilization 1–9%, clean history).

Dispute + Build

We challenge errors and help you add strong tradelines (secured loans, rent, credit-builder steps).

Trusted by Realtors & Loan Officers

They send us their clients to get them approved.

Over 300+ clients have trusted us to boost

their credit scores.

Your 3-Step Credit Comeback

Our proven process has helped hundreds improve their credit scores.

Here's how it works for you.

Enroll in Minutes

We open your file and build your roadmap to approval.

Dispute & Rebuild

We file impactful disputes and guide you to add positive tradelines

Track Your Score

Monthly updates (~35 days) so you know your path forward.

Our Simple System to Fix and Build Your Credit

Join ScoreCrest

Take the First Step Toward Homeownership

We only accept a small number of new clients each month to ensure personalized attention.

Don’t wait, your turn starts now

Founded by a former underwriter—no guesswork, just proven strategy.

10,000+

Credit Reports Reviewed

35 Day

Progress Reviews

300+

Families Guided

How long does credit repair take?

Most clients begin seeing changes within 35–45 days after their first dispute round, depending on how fast the credit bureaus respond.

That said, full restoration or mortgage readiness can take 3 to 6 months for moderate files and up to 12 months for heavier reports.

Each case is unique because every credit report has different accounts, ages, and violations under the Fair Credit Reporting Act (FCRA).

What happens after I sign up and pay?

Immediately after payment, you’ll be redirected to complete your onboarding, which includes verifying your identity, signing your client agreement, and linking your credit monitoring.

Once that’s done, your file enters our system for analysis and dispute preparation within 3–5 business days.

You’ll get access to your ScoreCrest Mobile App to track every update in real time.

Do you help with building credit, or just removing negatives?

We do both.

In addition to disputing inaccurate items, we help you build new positive credit through secured cards, rent reporting, and installment strategies that prepare you for mortgage underwriting.

Our goal isn’t just deleting accounts — it’s creating a strong, balanced credit profile that qualifies you for prime credit products and home loans.

Do you guarantee results?

No company legally can — and if they do, that’s a red flag.

Under the Credit Repair Organizations Act (CROA), no results can be guaranteed because the outcome depends on how credit bureaus and furnishers respond to our verified disputes.

What ScoreCrest does guarantee is professional work, FCRA-based disputes, and full transparency throughout your process.

Is credit monitoring required?

Yes — we require active credit monitoring so we can view your reports in real time and track your results accurately.

We work with trusted partners that provide full 3-bureau access for about $25–$28/month. Without monitoring, we can’t legally or effectively dispute under the Fair Credit Reporting Act (FCRA).

How do I cancel if I decide to stop?

You can cancel anytime by sending us a written notice via email.

There are no cancellation fees, but please note: all disputes in progress will stop immediately.

We always recommend reaching out first — our team can pause your file or adjust your plan if you just need a break.

Can you really remove collections, bankruptcy's, repos, charge-offs, or late payments?

Yes — if the accounts are inaccurate, unverifiable, or outdated under the FCRA, we can challenge and often have them corrected or deleted.

We don’t use “template” letters; each dispute is customized for accuracy and compliance.

How does credit repair actually work?

We analyze your credit reports for violations under the FCRA and FDCPA.

Then we prepare written disputes that legally require bureaus and creditors to verify, update, or delete the accounts.

Each round takes about 35–45 days to complete, and updates are visible directly inside your ScoreCrest Mobile App.

Do you work with loan officers or realtors?

Yes — ScoreCrest partners with licensed loan officers and real estate agents nationwide.

Our goal is to help you reach pre-approval status as fast as possible.

If you already have a lender, we can provide progress updates and lender-ready reports so everyone stays aligned.

What credit score do I need to get preapproved for an FHA loan?

Most lenders require at least a 620 FICO Mortgage Score, though some can go lower with larger down payments or compensating factors.

We focus on helping you reach a 640+ median mortgage score, which positions you for the best loan terms and smooth underwriting.

© 2025 Score Crest. All Rights Reserved.

ScoreCrest Solutions LLC is a credit repair organization under the Credit Repair Organizations Act (15 U.S.C. §1679 et seq.) and complies with the Fair Credit Reporting Act (15 U.S.C. §1681 et seq.). We cannot remove accurate, current negative information. Results vary by individual credit profiles.